Business Insurance in and around Tampa

One of Tampa’s top choices for small business insurance.

This small business insurance is not risky

Help Prepare Your Business For The Unexpected.

As a business owner, you have to think about all areas of business, all the time. The details can be overwhelming! You can save time by working with State Farm agent Chelsey Loper. Chelsey Loper relates to where you are because all State Farm agents are business owners themselves. You'll get a business policy that covers your concerns and frees you to focus on growing your business into the future.

One of Tampa’s top choices for small business insurance.

This small business insurance is not risky

Surprisingly Great Insurance

Did you know that State Farm has been helping small businesses grow since 1935? Business owners like you have relied upon State Farm for coverage from countless industries. It doesn't matter if you are a physician or an acupuncturist or you own an art store or a pizza parlor. Whatever your business, State Farm might help cover it with customizable policies that meet each owner's specific needs. It all starts with State Farm agent Chelsey Loper. Chelsey Loper is the agent who relates to where you are firsthand because all State Farm agents are business owners themselves. Contact a State Farm agent to learn more about your small business insurance options

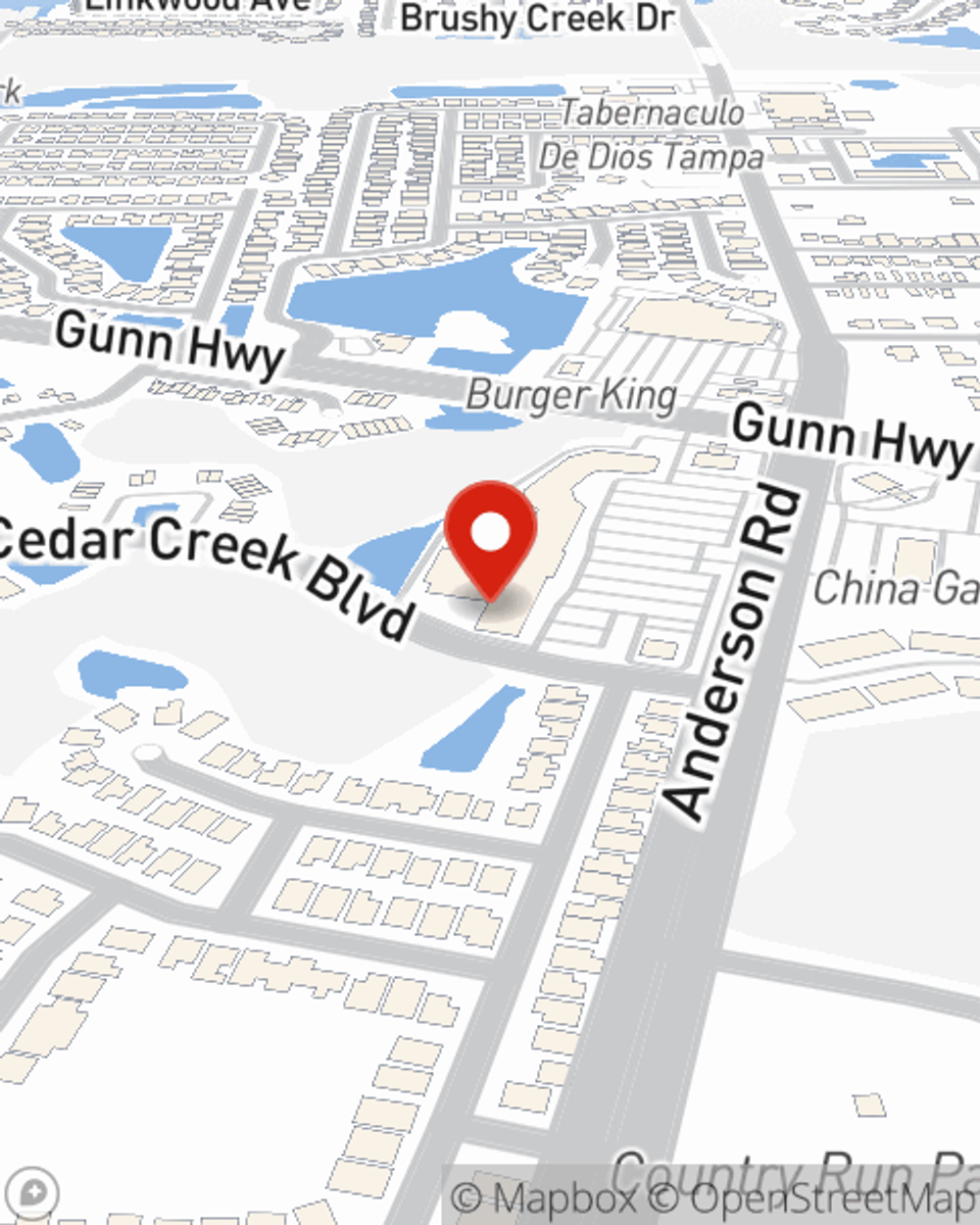

Contact State Farm agent Chelsey Loper today to explore how the trusted name for small business insurance can ease your worries about the future here in Tampa, FL.

Simple Insights®

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

Chelsey Loper

State Farm® Insurance AgentSimple Insights®

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?